I’ve always believed the best way to refine my thought process was to write things down, and for 2026 a goal of mine is to more actively share my takes publicly as a way to hold myself accountable. With ~200 followers on X I’m essentially screaming into the void as a lurker and happy to keep it that way. I have nothing, and will never have anything, to sell. This is purely an activity to make myself better and yada yada not financial advice. I started trading my PA in 2022 and coming up on a 3 year mark of returns means I’d like to hold myself accountable for the good and bad.

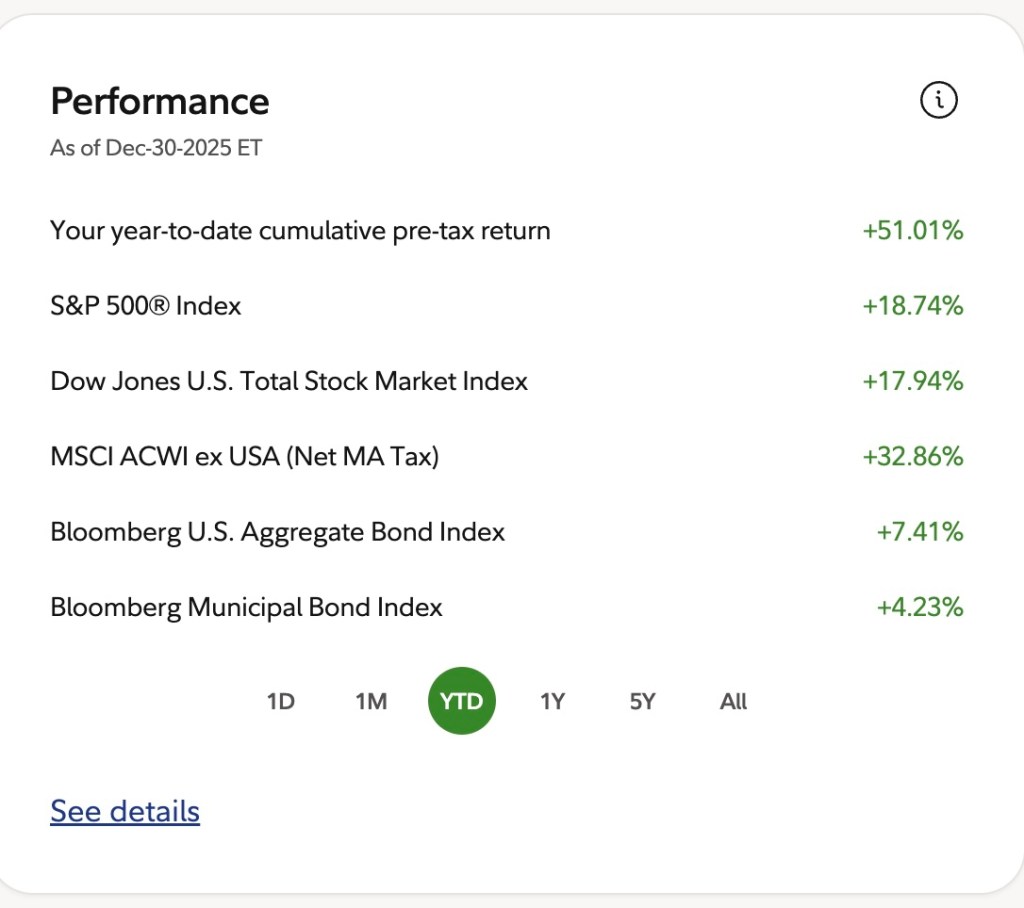

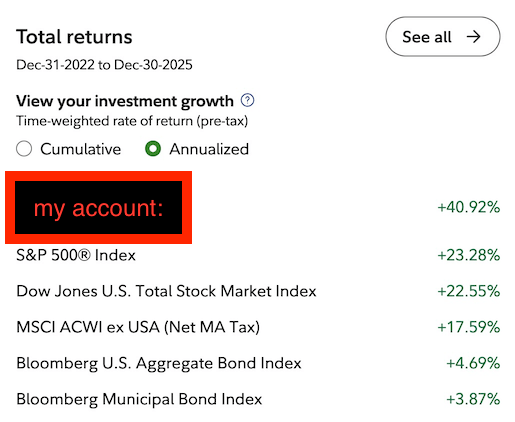

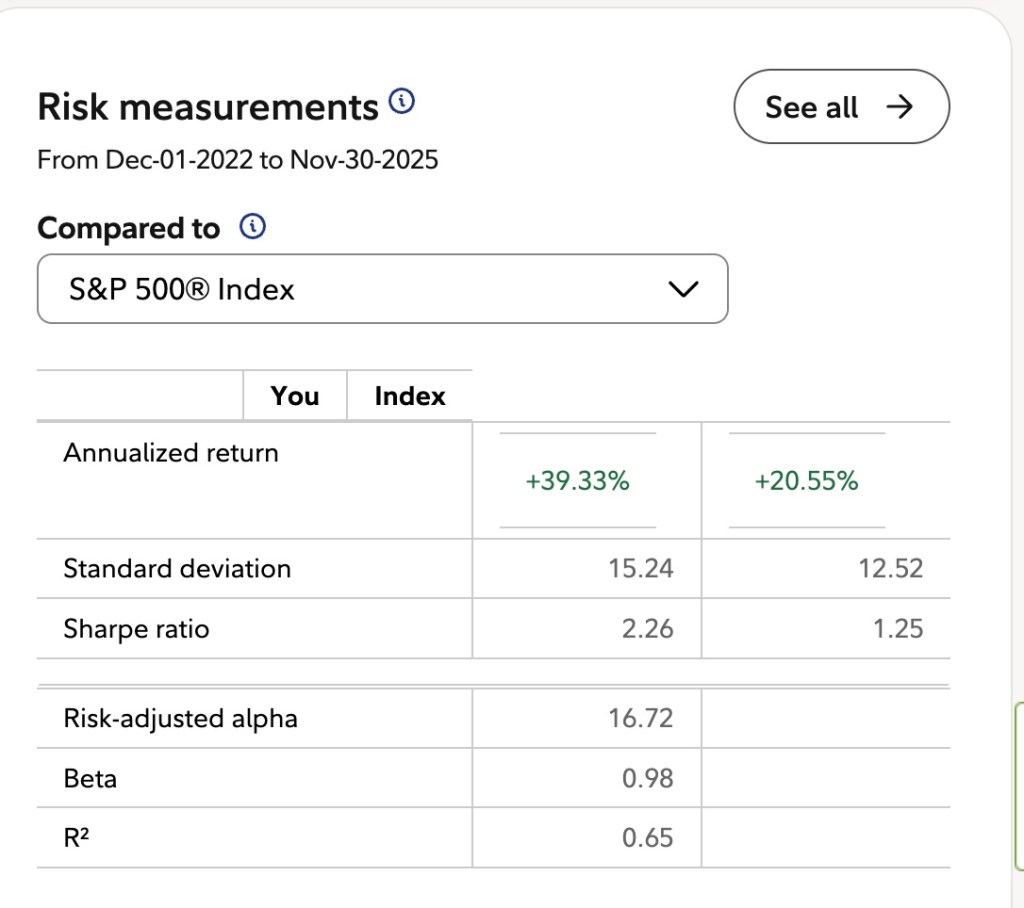

Performance:

It’s been a hell of a 3 year stretch for us all. SPY compounding at 23% annualized and QQQ around 29% with ample investment opportunities. I’ve been extremely lucky to start trading the personal account in 2022, and have set a few main guidelines for myself:

- Don’t Lose Money

- Return Above Alternative Investment Options – SPY/QQQ

- Play Games I Can Win

Don’t Lose Money:

Ultimately this money is mine and we are playing the long game. Enough size to make it worth pursuing, but small enough that my life would not be substantially altered should I break my rule. There is no EOY return hurdle that I need to hit for a bonus here, and no additional source of capital coming into this account so the goal is long-term return. I have no incentive to take on large amounts of risk for short term benefit.

The way I’ve avoided any significant drawdowns is by placing multiple stop-loss orders generally at 5-7% and 10-12% below any positions I take on. This of course has worked out in a bull market with a mainly long only portfolio and has major downsides in periods of higher volatility. Another major downside is potentially missing out on the upside of a position simply because of broader market movements that have nothing to do with my thesis. Also, I’ll scale up my stop-loss orders as a position grows: example being if a position rises 20% but there is still room to run on my thesis, I’ll move my stop-loss up with it. This isn’t necessarily the best way to do it, but it’s worked for me.

Return Above Other Investment Options – SPY / QQQ:

Money can go anywhere – under my mattress inflating away, in a HYSA, in some pink sheet you and I have never heard of, etc. My personal benchmarks for this account are SPY and QQQ and my goal is to slightly beat each, otherwise all I’m doing is a lot of homework just to lose money relative to where I would otherwise be invested. If I see no good investment opportunities, I am happy to sit entirely in SPY or QQQ until I find the next one.

Play Games I Can Win:

In this account, I answer to no one, have no career risk in taking on unpopular positions, and can go anywhere with my money. One thing I really benefitted off of in 2025 was avoiding a major drawdown during the tariff rollout, and having the ability to risk-on as things started to turn around. I don’t need to worry about having to answer why I missed out on timing the bottom or selling before hitting the top. I’m happy to forego some of the upside if it means I avoid a bit of drawdown.

Markets are the best game in the world. Every single day I wake up ready to catch up on the news, check my positions, listen / watch the latest podcast appearance someone gave, etc. If I won the powerball tomorrow, I’d probably be starting my morning the exact same way (with a bit more reading and golf in between). The world constantly changes and entropy continues to rise. We’re all just hoping we can piece together a little portion of the mosaic of life, I’d have it no other way. Here’s to 2026 and hoping we all outperform our personal benchmarks.